Indicators on What Is Trade Credit Insurance You Should Know

Wiki Article

The Buzz on What Is Trade Credit Insurance

Table of ContentsWhat Is Trade Credit Insurance Things To Know Before You Get ThisThe Best Guide To What Is Trade Credit InsuranceSee This Report about What Is Trade Credit InsuranceWhat Is Trade Credit Insurance Things To Know Before You Get ThisWhat Is Trade Credit Insurance for Beginners

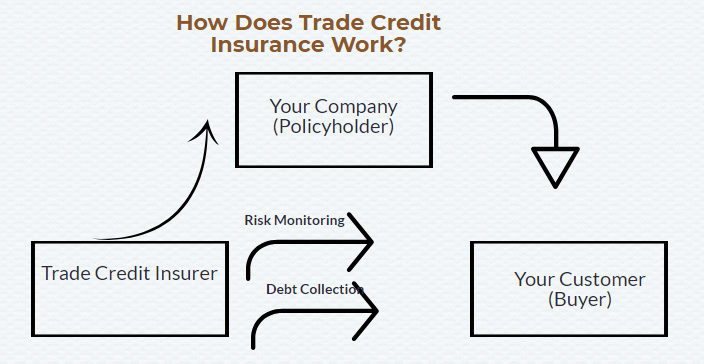

Trade credit report insurance coverage (TCI) reimburses firms when their clients are unable to pay as a result of insolvency or destabilizing political problems. Insurance companies commonly value their policies based upon the size as well as number of consumers covered under the policy, their credit reliability, as well as the risk fundamental to the industry in which they operate., which indicates the business creates its very own get fund specifically created to cover losses from unsettled accounts. The downside to this approach is that a business might have to establish aside a substantial amount of capital for loss prevention rather of making use of that cash to grow the company.

However, a variable generally buys the right to those receivables at a substantial discountusually 70% to 90% of the invoiced amount. The creditor may receive a larger portion if the factor manages to collect the full debt, but it still needs to pay a considerable charge for the aspect's solutions.

Essentially, it's a guarantee from the purchasing company's bank that the vendor will certainly be paid completely by a certain day. One of the disadvantages is that these can just be acquired as well as spent for by the buyer, which might be unwilling to pay the purchase cost amount for the financial institution's warranty.

How What Is Trade Credit Insurance can Save You Time, Stress, and Money.

That represents a compounded yearly growth rate of 8. 6%.

Rise in sales as well as profits A credit report insurance coverage can commonly counter its own expense often times over, even if the policyholder never makes a case, by raising a business's sales and revenues without additional risk. Boosted lender partnership Trade credit history insurance coverage can boost a company's partnership with their loan provider.

With trade debt insurance coverage, you can accurately manage the commercial and also political risks of profession that are past your control. Profession credit insurance coverage can help you feel safe in expanding much more debt to current clients or pursuing brand-new, bigger consumers that would have otherwise appeared as well dangerous. There are 4 kinds of trade credit score insurance, as described below.

The 45-Second Trick For What Is Trade Credit Insurance

Whole Turnover This kind of trade credit report insurance policy secures versus non-payment of business financial debt from all consumers. You can select if this protection puts on all domestic sales, international sales or both. Key Accounts With this sort of insurance, you choose to guarantee your largest customers whose non-payment would certainly position the best danger to your business.Transactional This form of profession credit report insurance coverage safeguards versus non-payment on a transaction-by-transaction basis as well as is ideal for firms with few sales or one client. Trade debt insurance just covers business-to-business balance dues from commercial and political risks. Arrearages are not covered unless there is direct profession between your company as well as a client (one more company).

It is usually not one of the most effective option, due to the fact that instead of investing excess funding into development opportunities, an organization must put it on hold in case of poor financial debt. A letter of credit scores is one more choice, but it only offers financial obligation security for one customer and Source also just covers global profession.

The variable supplies a cash advance ranging from 70% to 90% of the invoice's value. When the billing is collected, the factor returns the balance of the billing minus their charge. These prices might vary from 1% to 10%, based upon a selection of elements. Some factoring services will assume the risk of non-payment of the billings they acquire, while others do not.

The Ultimate Guide To What Is Trade Credit Insurance

Nevertheless, while receivables factoring can be beneficial in the temporary, you will need to pay charges varying from 1% to 5% for the solution, even if the receivable is paid completely within 60-90 days. The longer the receivable remains overdue, the higher the costs. Payment warranties aren't always readily available, as well as if they are, they can increase factoring fees to as high as 10%.The bank or element will certainly provide the financing and also the credit score insurance coverage policy will shield the invoices. In this instance, when a financed billing goes unsettled, the case payment will certainly go to the funder.

Credit scores insurance coverage shields your cash money flow. Profession credit insurance works look these up by insuring you against your purchaser stopping working to pay, so every billing with that client is covered for the insurance coverage year.

At Atradius Australia, we operate a Modula Credit Insurance Policy Plan. Atradius Credit history Insurance described: Your credit insurance firm must keep track of the economic wellness of your consumers and also prospective consumers and use a danger rating, usually called a purchaser rating.

The Definitive Guide to What Is Trade Credit Insurance

It will direct just how much of your direct exposure they are prepared to insure. The customer ranking is also a check these guys out helpful device for you. You can use it as an overview to sustain your very own due persistance and aid you stay clear of potentially risky clients. A solid buyer rating can also assist you protect prospective customers by supplying them good credit report terms.

Report this wiki page